Written by: <Authors><Author><Id>1624</Id><Name>Fibre2Fashion</Name><FriendlyName>fibre2fashion</FriendlyName><AuthorImage>/1624/f2f_logo.jpg</AuthorImage></Author></Authors>

Written by: <Authors><Author><Id>1624</Id><Name>Fibre2Fashion</Name><FriendlyName>fibre2fashion</FriendlyName><AuthorImage>/1624/f2f_logo.jpg</AuthorImage></Author></Authors>

Summary: Bandages have a small share in medical textiles market but are very crucial in healthcare. Wound care costs are expected to accelerate as average age of population increases, increasing demand for bandages. Supply for bandages will increasingly come from China/Chinese companies as European markets have gradually ceded their market shares. An analysis.

Wound-care products made of textiles constitute a small part of the medical textiles market, however they are of tremendous significance in the healthcare sector. This is reflected in the overall spending in Medicare in the US on wound care (acute and chronic) estimated to range between $28.1 billion and $96.8 billion in 2018.1 This accounted for at most 12.1 per cent of the total medicare expenditure in US. Although this expenditure is unavoidable as appropriate wound management is an essential part of recovery of patients from chronic as well as acute ailments. However, research continues to make dressings and bandages more efficient with higher recovery rate at lower costs.

Bandages as we have all been exposed to, are a crucial part of wound management. They are used to hold a wound dressing in its place and come in several types such as triangular or cravat, roller and tailed bandages. Adhesive bandages, more commonly known as Band-aid in the market are much shorter strips of plastic/woven fabric/latex meant for smaller wounds/cuts. Bandages in general come with various properties such as anti-microbial, elastic vs non-elastic and in specialised shapes for particular parts of the body. Given that wound care is ubiquitous in medical treatment, bandages are an almost indispensable part of our lives.

The focus of this note is particularly bandages as the demand for this segment of medical textiles moves largely in relation to the average age of the population in a country and how healthcare expenditure is managed there. While, COVID-19 led to a sudden jump in overall healthcare supplies (also for bandages), the trend for many commodity groups may not have changed structurally and will likely continue as it was pre-COVID.

Drivers for demand of bandages

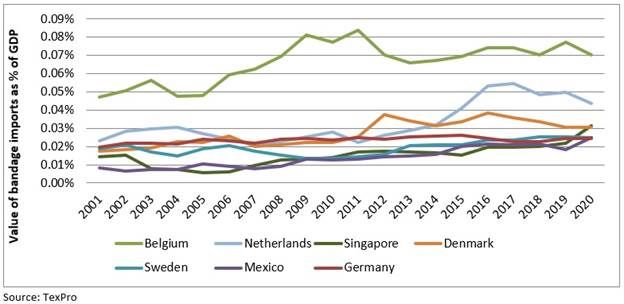

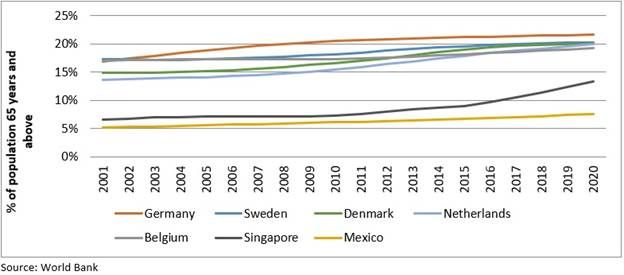

As the average age of population increases in many countries, demand for bandages is also likely to increase much faster. There is enough evidence suggesting that incidence of chronic wound increases with age. This is an important reason for rising demand for bandages. Import data of some of the rapidly aging economies also reflect this trend starkly. Figures 1 & 2 put together brings more perspective to this.

Taking a set of countries which have one of the largest bandage imports as percentage of GDP, these are also the countries with among the largest shares of old age population. This relation is not linear probably because of two reasons – 1) Some countries which have better health parameters in this group, might have relatively lower demand for bandages even if their share of old age population is among the highest (eg. Sweden and Germany) and 2) countries such as Japan which have among the highest shares of old age population, might not feature in this comparison because their domestic production of bandages is much larger, and they export more than they import. For that matter, China is the largest exporter of bandages globally, and has also seen the share of its old age population soar from 6.9 per cent in 2001 to 12.0 per cent in 2020. However, it is still significantly lower than Japan’s 28.4 per cent in 2020.

Figure 1: Major importers of bandages globally

Figure 2: % of population with age 65 years and above

There is another qualification in this comparison. The countries which import the largest absolute value of bandages are not necessarily fit for correlation with old-age population share as imports are also a direct function of the size of economy. United States is the largest importer in absolute terms but that is perhaps because of its size, as the ratio of imports of bandages to its GDP is a mere .007 per cent and its old-age population is still 16.6 per cent of the total. However, both imports of bandages as percentage of GDP and share of old-age population have increased in US over the years. So, even though the mapping between old-age population share and bandage imports may not be linear at a given point, the relation between the two is a positive one across time. This then suggests that increasingly demand is going to emerge from countries with rising old-age population and perhaps countries with larger incidence of chronic illnesses.

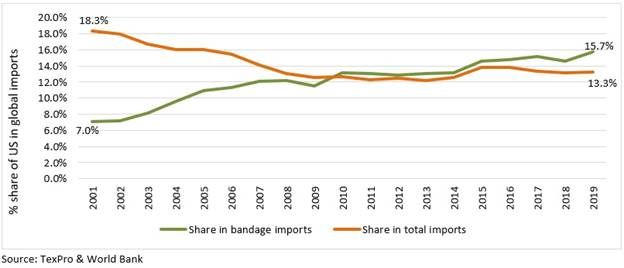

High share of wound care expenditure in the United States, as highlighted in the beginning, is also reflected in its rising share in bandage imports. US’s overall share in global bandage imports has gone from 7.0 per cent in 2001 to 15.7 per cent in 2019, while its share in overall global imports has fallen from 18.3 per cent in 2001 to 13.3 per cent in 2019. This could largely be a reflection of the relatively higher incidence of chronic ailments such as diabetes (diabetic foot ulcers require bandage for dressing), affecting 10.8 per cent2 of adult population in the US. The IDF Diabetes Atlas also shows that per-capita mean expenditure on diabetic care in US was the second highest globally at USD 9,505.6 in 2019.3

Figure 3: US’ share in global bandage and overall imports

Such a contrast between bandage and overall imports is not visible for any other country. European countries such as Germany, France, United Kingdom, Netherlands and Belgium lead import demand in this segment and had a combined import share of 33.3 per cent in 2019. It is likely that this group will be pushing demand for bandages going forward as these are also some of the most rapidly ageing nations today.

Where do bandages come from?

The supply side of the market has increasingly become more dependent on China. The figures for actual production may not be as readily available but the global supply chain structure is well indicated by the export market shares of different countries. Within the broad trade category of bandages (HS Code: 3005) there are two types: 1) HS Code: 300590 - Wadding, gauze, bandages and similar articles; (excluding adhesive dressings), impregnated or coated with pharmaceutical substances, packaged for retail sale and 2) HS Code: 300510 - Dressings, adhesive; and other articles having an adhesive layer, packed for retail sale for medical, surgical, dental or veterinary purposes. Both types of bandages constitute almost similar shares in global trade, but the market structures in the two are very different.

China’s share in both the categories has increased dramatically over the years. For wadding, gauze bandages and related articles (300590), China’s share in global exports increased from 22.5 per cent to 24.7 per cent in 2019 and further to 30.8 per cent in 2020. In this category, other large players such as United States, United Kingdom, Germany and Belgium have lost share between 2001 and 2020, while Netherlands has also gained massive share from 1.8 per cent in 2001 to 7.9 per cent in 2019 and 6.0 per cent in 2020. The picture in 2020 should be considered transitory as supply chain in other countries except China were disrupted heavily. For dressings, adhesive bandages and related articles (300510), China has made immense strides in the last two decades, growing its share from 0.9 per cent in 2001 to 12.9 per cent in 2019 and 13.3 per cent in 2020. Several European countries have lost considerable shares in this segment over the same period. Particularly, shares of UK went from 20.0 per cent to 10.7 per cent, of Germany from 15.2 per cent to 8.0 per cent and of Belgium from 19.0 per cent to 5.5 per cent between 2001 and 2020.

The relative positioning of countries in this segment has remained almost the same post 2012 and much of the re-shuffling in the segment happened before that. Share of US has moved marginally from 14.3 per cent in 2013 to 12.0 per cent in 2020, while UK, Germany and Netherlands have also managed to keep their shares largely intact. Belgium has lost tremendous share from 9.4 per cent to 5.5 per cent, while China has gained a small proportion.

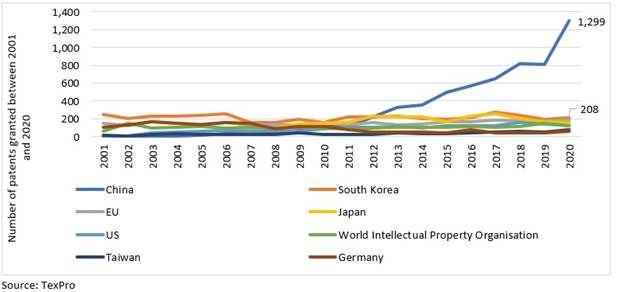

China’s relative outperformance in bandages is not just in volume of exports but also in innovation in this segment. Data available from the patent’s module in TexPro shows that China has also emerged a leader when it comes to research & development in bandages. The relative gains in exports in this commodity group for China and relative speed of innovation has moved in tandem. Figure 4 shows that China overtook US as the front-runner in innovation back in 2010 and has now left other countries behind by a wide margin. Corresponding to this, China also spends heavily into R&D in textiles. According to data on R&D expenditure from OECD, China invested $5.6 billion in textile R&D in 2017, while the second highest investment was by Japan worth $1.7 billion.

Figure 4: Patents granted related to bandages between 2001-2020

This sets the tone well for future of supply in this market. Chinese companies dominate the supply of bandages globally. With relatively greater capacity and much bigger innovation capabilities, China is poised well to keep its market share intact if not increase it further. One reason for this is that other major centres of activity in textiles such as Bangladesh, Vietnam, India and Turkey among others haven’t ventured much into medical textiles prior to the pandemic and would require higher investments to compete with China’s scale. US and European countries are expected to see a continued decline in share of bandage exports, as China would likely expand its investments further. It is also highly likely that Chinese companies will make investments in medical textiles in countries along the Belt and Road Initiative, which they have already started doing and this will impact supply dynamics in this sector. This also squares well with China’s policy to shift manufacturing away from lower value-added goods. Bandages (medical wound dressings) are categorised as low-value consumables as per the Blue Book of Medical Devices Industry in China and constituted roughly 21 per cent share in China’s total medical devices market.

Bottomline

As the world ages further, demand for bandages is expected to rise tremendously, and European countries and Japan will contribute a large part of it. Historically, China’s share in bandage supply has risen and leading players like Belgium, UK and Germany have lost export shares. With huge capacity in textile, and with China’s plans to further invest in technical as well as medical textiles, bandages will increase from east to west.

References:

1https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6389759/

2https://www.diabetesatlas.org/data/en/indicators/2/

3https://www.diabetesatlas.org/data/en/indicators/19/