Kevin Young & Tom Lucas

VP of Corporate Development & Project Manager

Web Industries

TT: Give us a background about your company. What is the size and scope? What are the milestones achieved by you in the last 50 years?

Because we are a privately held employee-owned company we do not share our gross sales in the marketplace, but Web has had a record of continuous growth during its 50-year history. Indeed, achieving 50 years is a significant accomplishment, and we are poised to grow for many more.

A major turning point in our company's history was when our founder Bob Fulton decided to sell the company to the employees. He felt that his success was largely due to his employees and he wanted to give back to them. This proved to be a beneficial business decision, as well. Our employee-owners have a vested interest in Web's success, and they take personal pride in providing great products and services to our customers. Another highlight took place in the early 2000s when we realigned our business along vertical market segments. This focus has allowed us to become intimate with the trends that affect our customers' portfolios and guides us on how to best service them.

TT: Where do you source your raw materials from?

As a contract manufacturer, we are material agnostic. Web can work with customers' preferences and convert virtually any type of flexible material, including nonwoven, film, paper, paperboard, tissue, foam and foil. Alternatively, based on a specification, we will source the material from any number of vendors.

TT: Which are your major export markets and clients?

Today our major export markets are in hygiene, especially in Asia, India and South America.

TT: On what parameters does Web Industries score over its rivals in the converter business? What are your strengths as a company?

Relationships! Decades of experience, growth and innovation, the scale of our converting services and speed to market.

TT: What are the benefits of large-format spooling and repeat-in-variance printing?

Large-format spooling at Web means two things to customers. 1) Large outputs that run for a longer time on production lines. This reduces scrap, downtime and handling, all of which leads to greater throughput for our customer. 2) Large scale! Web can convert large quantities quickly and with less scrap and edge trim. Both cut converting costs.

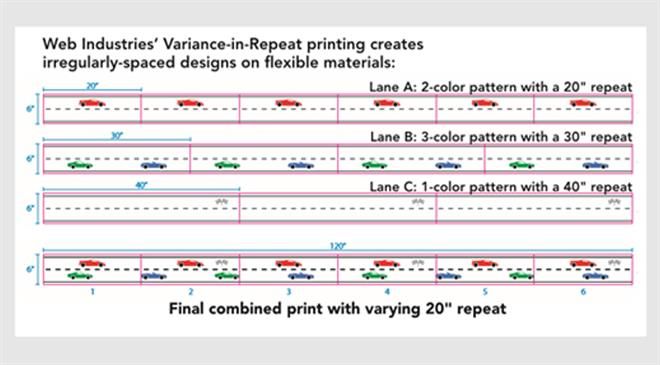

Variance-in-repeat printing creates multiple repeat designs in the same print run. The printing capability enables Web's customers to bring a variety of designs to market, rather than a single uniform design. For example, images of flowers can vary by location instead of appearing in the same place every time. This allows a customer with multiple SKUs to minimise costs related to additional plates and costs associated with changeovers.

TT: Sustainability the world over has become a key issue. Which are the areas in your supply chain where you are adopting sustainability into?

There are many ripe opportunities for cutting back on transportation and energy. Plus, we are eliminating scrap associated with starting a roll, edge trim, reducing or reusing packaging materials, and recycling where we can.

Web's large and extra-large format winding reduces packaging because the customer handles one large spool as opposed to many pad rolls.

TT: Which market segments does Web Industries cater to? Which of them generates the most revenue and why?

Web Industries has a diversified portfolio. We supply our precision formatting and contract manufacturing services to four market sectors: Personal & Home Care, Medical, Aerospace and Industrial. Our largest business segment is Aerospace. Diversification is a good business strategy because it reduces risk or dependency on any one market. Market segments can be cyclical, and diversification can level out spikes in demand.

Aerospace has been our fastest growing segment due to the transition on twin aisle aircraft to composite wing structures. This has been a plus for our precision slitting capabilities. In addition, our 2012 acquisition of CadCut equipped us with ply cutting and kitting services that have resulted in good company growth.

With P&HC (personal and home care), price compression is driving demand for innovation and cost optimisation.

Major brands focus on innovation, but the ability of private labels to copy these innovations and get products into market quickly cuts the time that brands have to enjoy the benefits of their innovations. So, the brands and contract manufacturers are looking into suppliers like Web Industries to provide innovations that cut costs. Web Industries, for example, is bringing to market and advocating the use of traverse wound spools in large and extra-large formats that lower costs by increasing throughput and reducing waste.

TT: You are planning an expansion of your Denton, TX, manufacturing facility. How much will it increase the plant's production capacity? When is the space going to get operational?

We are doubling our capacity. The 20,000 sq ft expanded area of the plant is filled with equipment and in the process of coming fully online. We are upgrading and modernising the plant's existing 20,000 sq ft capacity.

TT: How much are you investing in upgrading your machinery on a yearly basis? Are your machines Industry 4.0 compliant yet?

We are constantly investing in new capital equipment to remain state of the art and competitive in our markets. For example, at our Fort Wayne, Indiana facility, in 2018, we brought on board the largest format spooler in the industry and two multi-colour presses.

Throughout our various business units, all new equipment purchased is state-of-the-art, 4.0 compliant and meets all safety and quality requirements. This is especially important in highly regulated industries like medical and aerospace. We are also relentlessly focused on cyber security.

TT: How much do you think technical textiles / nonwovens will dominate the next decade? In what way(s)? In which particular sectors/applications are we likely to see most of that kind of dominance? Could you please elaborate?

We expect to see an increase in the use of technical textiles and nonwovens by 50 per cent over the next decade.

The hygiene markets will see growth. However, other consumable products such as wipes, diapers, trash bags, tissue, towel, cleaning and bathing products that use nonwovens tend to be population-based. And population does not increase that quickly.

We will probably see additional nonwovens use in the construction and landscaping markets. House-wrap and landscaping underlayment have been made from these materials for years, but the materials are now expanding into products like shingles and might even find use in carpet backing one day. In addition, look for these materials to expand further into the medical gowning and drape sectors.

TT: As a market, which world region is growing at a faster pace compared to others and why?

Asia, India and South America. Populations in these regions are starting to use more hygiene items. Also, their construction markets are booming.

TT: What are the emerging trends in your niche and the reasons behind them?

For hygiene, demand for lighter weight, softer materials and materials with functionality like fluid flow management is trending. Across all markets, sustainability is on the forefront. For an example, we see a great opportunity for using less packaging materials. There is even greater benefit if the market becomes receptive to multiple packs rather than single wrap packages.

TT: Which are the key factors affecting market dynamics - the drivers, challenges, and business risks in your niche?

Cost is always a key factor. Plus, customers tend to design products that use one material and then change to a different material a few years later, and that can sometimes present a production challenge.

Business risk in these markets include investing in capabilities or capacity without business contracts.

It is worth noting that Web Industries is helping customers to drive efficiencies through large and extra-large format traverse winding, which allows materials to run 25 times longer than roll pad winding before being changed out. These materials within a spool can now be slit up to 12 inches wide due to Web Industries' new unique and proprietary spooling capability.

TT: What are your future expansion plans? Any mergers and acquisitions in pipeline?

We recently broke ground on a new manufacturing facility near Seattle to support our aerospace customers. Plus, there is our Denton, Texas, expansion and the two factories we added in France with the acquisition of Omega Systèmes in 2019. So that is a considerable capacity expansion, and it follows on the expansion we completed at our Fort Wayne, Indiana plant in 2018. So, we have heavily invested in infrastructure and facilities to meet growing customer demand.

Looking ahead, our investment strategy will keep pace with existing and anticipated demand as it rises.

Published on: 11/03/2020

DISCLAIMER: All views and opinions expressed in this column are solely of the interviewee, and they do not reflect in any way the opinion of technicaltextile.net.