On a constant currency basis, net sales for composite fibres decreased 4.4 per cent and increased 47.7 per cent for airlaid materials (including Mount Holly). The spunlace segment, formed in connection with the Jacob Holm acquisition, had net sales of approximately $96.9 million for the second quarter, the company said in a press release.

“In the second quarter, we outperformed operating profit expectations at the enterprise level driven by composite fibres and airlaid materials, however, we were disappointed with our Spunlace segment results," said Dante C Parrini, chairman and chief executive officer. “By intensifying efforts to mitigate inflationary pressures, we were successfully able to increase prices, drive operational efficiencies and tightly manage spending in the composite fibres and airlaid materials segments. Since announcing our dynamic pricing model initiative for the composite fibres segment in early 2022, we successfully converted 50 per cent of its revenue base to a cost pass-through mechanism ahead of plan, which is materially helping to offset the impact of higher raw material, energy and logistics costs. Airlaid materials delivered solid performance with profitability stronger than expected due to pricing actions including energy surcharges, favourable product mix and the successful execution of a capital project at our Falkenhagen facility.”

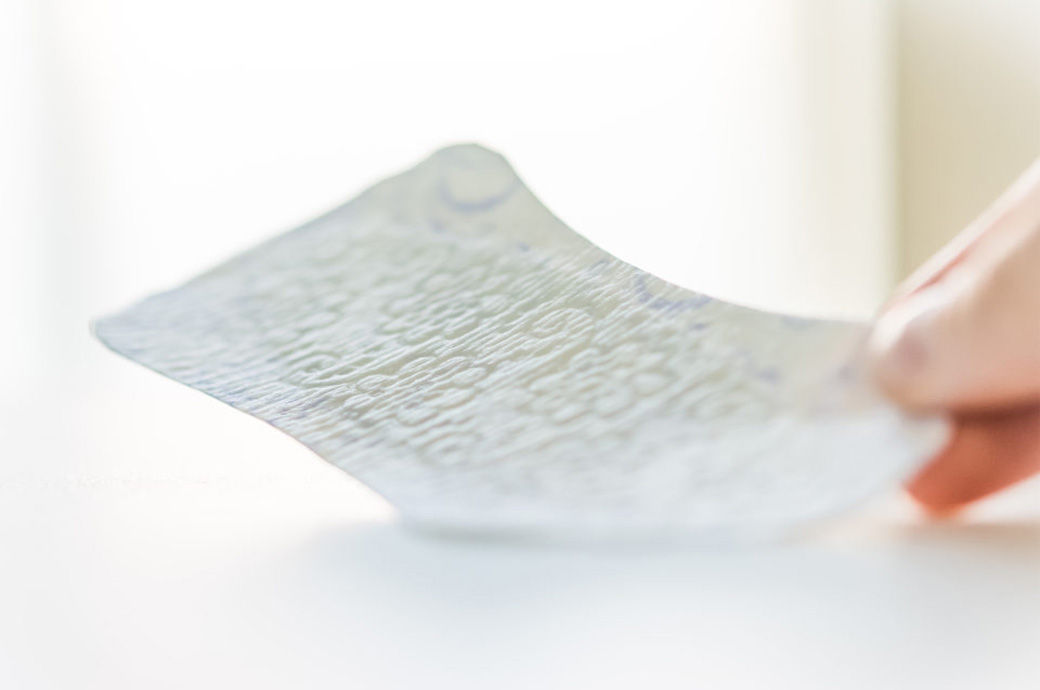

“Our spunlace segment faced substantially higher than expected inflationary challenges during the quarter and our price increases were insufficient to offset the impact. Supply chain disruptions also affected raw material availability, which curtailed production and product shipments. As a result, the segment was unable to sufficiently narrow the price/cost gap for its products primarily due to the impact of rising energy prices in Europe and the impact of higher oil prices on certain raw materials. We recently took aggressive cost actions to further right-size the legacy Jacob Holm leadership team and more deeply integrate the segment into our existing operating model, while concurrently implementing additional pricing actions to counteract inflation. Despite the near-term challenges in this segment, we remain committed to its success and the strategic purpose it contributes to the Glatfelter portfolio,” Parrini continued.

“In response to the challenging business environment that we anticipate will continue at least for the remainder of 2022, we remain keenly focused on improving spunlace performance and executing an intensive enterprisewide initiative aimed at rapidly improving Glatfelter's overall profitability and execution capacity. Additionally, we are closely monitoring the Russia/Ukraine conflict, the complexities and risks with the energy situation in Europe and the ongoing inflation trends to determine the necessary actions needed to bolster our performance while continuing to serve our customers. Finally, as we navigate this ongoing period of unprecedented market and geopolitical turbulence, we remain confident that the company's reshaped portfolio of engineered materials, used to produce essential consumer staples, will successfully deliver strong growth and more stable profitability over the long-term,” Parrini concluded.

Fibre2Fashion News Desk (RR)